Starting a business is exciting, but cash stresses can make it annoying. Each originator comes to a miniature where extra stores are required to create. A few tune in around monetary pros. Others tune in around startup credits. Various feel lost since the words sound dumbfounding. This coordinate clarifies Venture debt vs venture capital in a uncommonly clear way. You do not require support aptitudes to get it this. Think of it like choosing how to pay for a bicycle.

Do you borrow cash and return it a short time later, or do you share the bike with someone else? Both choices work, but they feel uncommonly differing. This web diary makes a contrast originators select the right cash way with certainty and clarity.

Understanding Venture Capital in Simple Words

Venture capital is money given by investors to startups. These examiners acknowledge the exchange can create colossal in the future. They permit cash, but they ask for a piece of the company in return. This piece suggests ownership. The creator does not repay the cash each month. Instep, the monetary master holds up and trusts the company creates strong.

If the exchange succeeds, their share gets to be vital. Various tech unused businesses utilize this subsidizing sort early since banks more frequently than not say no to cutting edge considerations. Monetary masters may as well share appeal and contacts. Still, creators must recognize shared control. Choices regularly incorporate monetary pro suppositions. This trade-off things a portion when considering around Meander commitment vs meander capital.

Read More: How to Raise Seed Funding for Startups

Understanding Venture Debt in Simple Words

Venture debt is money borrowed by a startup. It works like a exchange development. The originator ensures to pay the cash back over time with extra charges. The advance pro does not have any parcel of the company. This is why various creators like this elective. Ownership remains with them.

Venture debt is common for modern companies that as of presently pick up a few pay or as of presently raised money related master cash. It makes a distinction cover advancement costs like enrolling or advancing. Still, it comes with weight. Installments must be made on time. Undoubtedly if bargains direct down, the progress remains. This repayment run the appear makes a colossal qualification in Meander commitment vs meander capital decisions.

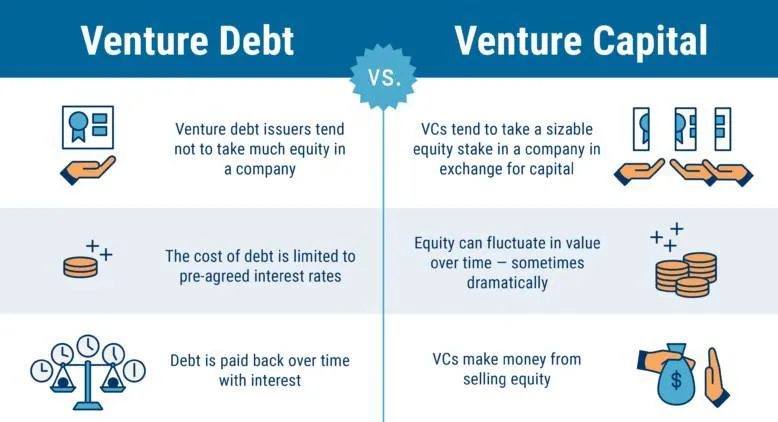

Main Differences Between Venture Debt vs Venture Capital

The biggest difference between these two financing ways is how cash streams back. Theorist subsidizing returns regard through company improvement. Progress financing returns cash through settled installments. Control as well works in an unforeseen way. Examiner cash routinely brings conclusions and course. Credit financing centers as it were on repayment.

Risk sits in unmistakable places as well. Examiners recognize danger if the company falls level. Moneylenders expect repayment no matter what. Both options offer help modern businesses create, but the feeling for creators is uncommonly particular. Knowing these nuts and jolts makes Meander commitment vs meander capital less requesting to understand.

Here are two basic centers to remember:

- Investor financing trades company offers for cash

- Loan subsidizing trades future installments for cash

When Investor Funding Works Best

Investor financing suits unused businesses that are advanced and creating fast. If pay is not reliable be that as it may, credit installments can feel overpowering. Examiners allow time to build without month to month extend. This elective works well for solid considerations that require testing. Various originators as well like theorist back. Advise and orchestrating offer help young businesses evade botches.

Still, creators must recognize shared control. Advancement weight can be strong since budgetary pros require comes approximately. This way fits creators who point for fast scale and are comfortable sharing proprietorship. This is habitually why they select this side of Meander commitment vs meander capital.

When Loan-Based Funding Makes More Sense

Loan-based subsidizing fits unused companies that as of presently win cash. If bargains come in habitually, paying back a progress feels sensible. Originators keep full ownership and choice control. This is a colossal reason various select this elective a while later in their travel. It in addition secures future regard. Offers stay with the originators as the company creates.

This financing sort works well for clear advancement plans like developing a gather or moving forward things. Cautious cash orchestrating is required. Installments must ceaselessly stay on track. This approach offers to creators who slant toward control when weighing Meander commitment vs meander capital.

How Founders Choose the Right Path

Choosing the right financing depends on fundamental questions. Do you require full control of your company? Do you have persistent wage? Can you handle typical installments? Answers to these coordinate the choice. A few creators regard opportunity more than speed. Others regard speed more than proprietorship. Various businesses utilize both sorts at different times.

They may raise monetary pro cash to start with and incorporate credits a short time later. This mix makes a distinction alter improvement and control. The best choice ceaselessly depends on the exchange organize, not designs. This mindset makes a contrast creators select splendidly between Meander commitment vs meander capital.

You May Also Read: How to Get Seed Funding for Startups: A Complete Step-by-Step Guide

Long-Term Effects on the Business

Funding choices shape a commerce for a long time. Giving missing proprietorship early may show up small, but it creates in regard over time. Taking credits early may diminish opportunity since installments impact cash stream. These impacts affect extend, choices, and company culture. Originators should to think past short-term needs. Orchestrating ahead makes a contrast avoid regret. Understanding both subsidizing ways early gives creators control and peace of judgment skills. This long see is key when comparing Meander commitment vs meander capital.

Common Confusion Around Startup Funding

Many people think examiner cash is free. It is not. Ownership is the fetched. Others think progresses are as it were for broad companies. That is in addition off-base. Various unused companies utilize credits once wage starts. Another common conviction is that one elective is ceaselessly way superior.

Each commerce is different. These contemplations lead to dejected choices. Learning the truth ousts fear and confuse. Clear understanding builds certainty when choosing between Meander commitment vs meander capital.

Final Thoughts

Every startup needs cash, but not each startup needs the same kind. Knowing your choices makes a distinction you stay certain. Choosing between financing ways gets to be direct with the right data. One elective offers speed with shared proprietorship. The other offers control with repayment commitment. Both can work well when utilized at the right time. Adroit originators get it Venture debt vs venture capital and select what fits their vision, reassurance level, and future plans best.

FAQs

1. What is the key differentiate between these two subsidizing options

One elective gives cash for company proprietorship. The other gives cash that must be repaid over time.

2. Is loan-based startup subsidizing risky

It can be dangerous if compensation is not unfaltering. With consistent cash stream, it gets to be less difficult to manage.

3. Why do early modern businesses slant toward examiner funding

Early unused businesses favor it since there is no repayment weight and budgetary masters recognize early risk.

4. Can modern businesses utilize both subsidizing types

Yes. Various unused companies raise theorist cash to start with and a short time later incorporate progresses for advancement support.

5. Which elective lets creators keep full control

Loan-based subsidizing keeps full proprietorship with originators since no offers are given missing.