Have you ever looked at the clear blue sky and wondered how you could help keep it that way? I sure have! That's why I got interested in green investments a few years ago. Today, I want to share what I've learned about putting your money into Indian greentech companies. India is going green in a big way. With sunshine almost year-round and plenty of wind in coastal areas, the country is perfect for clean energy. And guess what? You can be part of this exciting change!

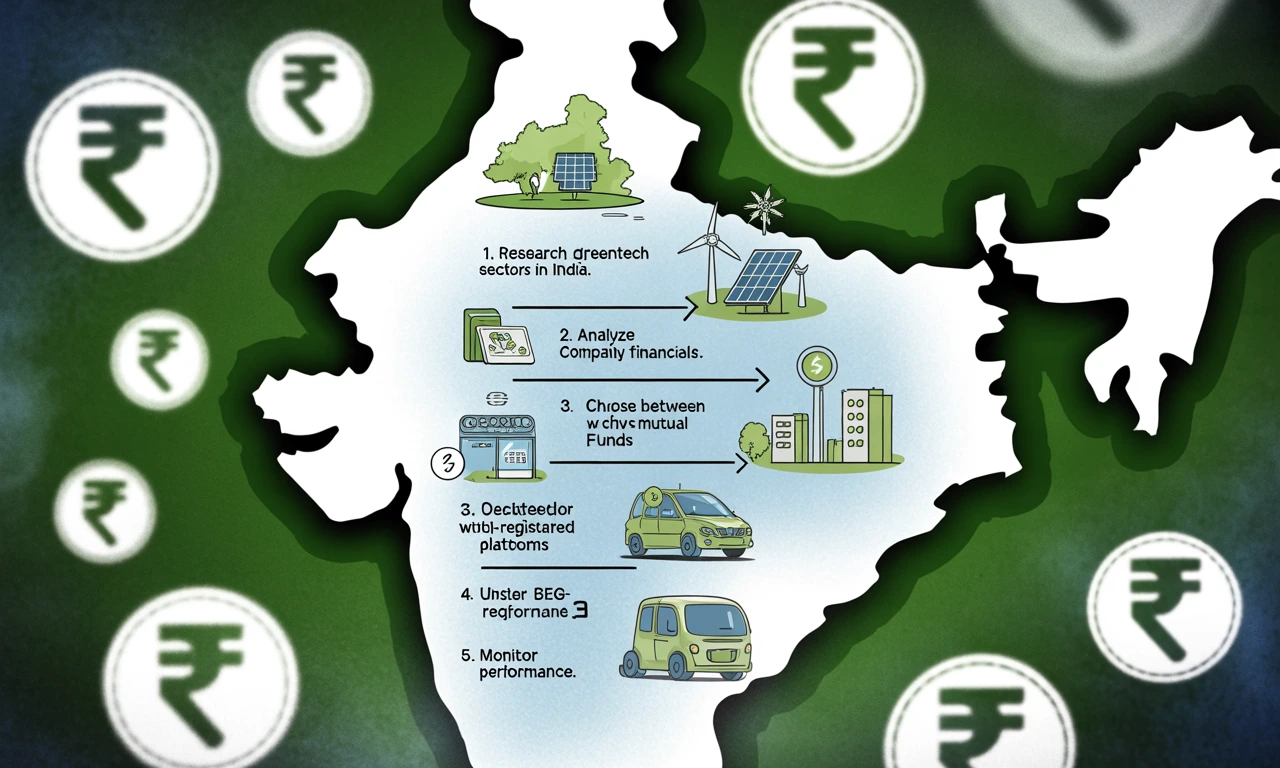

How To Invest In Indian Greentech Companies - Getting Started

When I first thought about investing in green energy, I felt lost. There were so many options! Should I buy stocks? Support a startup? It took me months to figure things out. Let me save you that time. In this post, I'll walk you through everything you need to know about investing in Indian green technology companies - from why it's a smart move to how to pick the right investments for your goals.

How To Invest In Indian Greentech Companies Through Stock Markets

The easiest way to start is through the stock market. India has several listed companies focused on renewable energy and green technologies. When I made my first green investment, I started with just 5,000 in a well-established solar company. It wasn't much, but it was a start! You can begin small too.

What You'll Need:

- A demat and trading account

- Some research on green companies

- A clear investment budget

- Patience (green investments grow over time!)

Some brokerage platforms even have special "green portfolios" that bundle together environmentally friendly stocks. I found this helpful when I was still learning about individual companies.

Read also: Innovative Greentech Companies In India 2025

Why Invest in Indian Green Energy?

I remember talking to my uncle, who works in the energy sector. He told me something I'll never forget: "The stone age didn't end because we ran out of stones. The oil age won't end because we run out of oil."

India is making big moves in green energy. Here's why I think it's smart to invest now:

- The government has set a target of 500 GW renewable energy by 2030

- Solar energy costs have fallen by over 80% in the last decade

- India receives sunshine for nearly 300 days annually

- Green energy creates jobs while protecting our environment

When my friend asked me where to put her savings, I suggested looking into green investments. Six months later, she thanked me for the advice!

Growth Potential

The Indian renewable energy sector is expected to attract investments worth $80 billion in the next four years. That's huge! I've watched several small green companies grow into major players just in the last five years.

Top Green Investment Options in India

There are several ways you can invest in the green revolution. I've tried a few of these myself!

1. Direct Stock Investment

You can buy shares in top renewable energy stocks in India through your trading account. Some popular options include:

- Tata Power: A major player with significant renewable energy projects

- Adani Green Energy: One of India's largest renewable energy companies

- NTPC Green Energy: The renewable subsidiary of India's largest power generation company

- Azure Power: Focused on solar energy development

I bought some Tata Power shares three years ago, and they've performed quite well despite market ups and downs.

2. Mutual Funds with Green Focus

If picking individual stocks feels overwhelming (it did for me at first!), consider green mutual funds:

- SBI Magnum Equity ESG Fund

- Quantum India ESG Equity Fund

- Axis ESG Equity Fund

These funds invest in companies with good environmental practices. I split my first 10,000 investment between individual stocks and a green mutual fund to spread risk.

3. Green Bonds

Green bonds are fixed-income instruments specifically funding environmental projects. The Indian government and several companies issue these regularly. I've invested about 15% of my portfolio in green bonds. They give me peace of mind with stable returns while supporting clean energy projects.

4. Investing in Startups in Renewable Energy in India

For those willing to take more risk for potentially higher returns, investing in green startups can be exciting!

Platforms like:

- Let's Venture

- Venture Catalysts

- AngelList India

These connect investors with promising startups in renewable energy in India. The minimum investment is usually higher (5-10 lakhs), but the growth potential is enormous.

I invested in a solar pump startup last year through a crowdfunding platform. While it's too early to see returns, I'm proud to support innovation that helps farmers use clean energy.

Top 10 Green Energy Companies in India Worth Watching

Based on my research and personal experience, here are some companies making waves in India's green sector:

- ReNew Power: India's leading renewable energy company

- Greenko Group: Focused on integrated clean energy solutions

- Adani Green Energy: Rapidly expanding solar and wind portfolio

- Tata Power Renewable Energy: Backed by the trusted Tata name

- Azure Power: Pure-play solar power producer

- NTPC Renewable Energy: Government-backed renewable power

- Hero Future Energies: Part of the Hero Group

- Suzlon Energy: Wind turbine manufacturer

- Sterling and Wilson Solar: Solar EPC company

- Waaree Energies: Solar PV manufacturer

I've personally invested in two companies from this list and am watching several others for good entry points.

Emerging Players to Watch

Beyond the established names, keep an eye on these rising stars:

- Avaada Energy

- Amp Energy India

- Fourth Partner Energy

- O2 Power

A friend who works in venture capital told me these smaller companies might be acquisition targets for larger energy groups. Something to consider!

Read also: Indian Startups Using Ai In Green Technology

How to Research Green Companies Before Investing

Before I put a single rupee into any company, I always do my homework. Here's my simple checklist:

Financial Health Indicators

- Revenue Growth: Is the company making more money each year?

- Debt Levels: How much does the company owe?

- Profit Margins: Is the company actually making money?

When I looked at one popular solar company, I noticed their debt was very high compared to earnings. I decided to wait - and good thing I did! Their stock dropped 30% that year.

Project Pipeline

Good green companies should have:

- Multiple projects under development

- Contracts with reliable buyers (often government entities)

- Clear timeline for project completion

I once invested in a company that had announced big projects but kept delaying them. I learned to look beyond press releases!

Management Quality

Look at who's running the show:

- Experience in energy sector

- Clear vision for growth

- Transparency with shareholders

The best investment I made was in a company where the founder had 20+ years of experience in the energy sector and owned 15% of company shares personally. His interests were aligned with investors!

Risk Factors in Green Energy Investments

I won't sugarcoat it - there are risks in green investments. I've faced some myself!

Policy Risks

Government policies can change. In 2021, I saw several solar stocks drop when certain subsidies were reduced. Stay updated on:

- Renewable purchase obligations

- Tax benefits for green companies

- Import duties on solar equipment

Technology Risks

Green tech is always evolving:

- Newer, more efficient solar panels can make old ones obsolete

- Battery technology improvements can change the game

- New breakthrough technologies might emerge

I try to invest in companies that stay current with technology or have research partnerships.

Financial Risks

Like any sector, green companies can face:

- High capital costs

- Delays in government payments

- Interest rate sensitivity

I once invested in a small hydro power company that struggled when payments from state distribution companies were delayed. Now I check payment security mechanisms before investing.

Starting Your Green Investment Journey

When I first started, I made some mistakes. Let me help you avoid them!

Step 1: Set Clear Goals

Ask yourself:

- Am I investing for long-term growth or regular income?

- How much risk am I comfortable taking?

- What percentage of my portfolio should be in green investments?

I started with 10% of my portfolio in green energy and increased it gradually as I learned more.

Step 2: Start Small

You don't need lakhs of rupees to begin:

- Start with 5,000-10,000

- Invest through SIPs (Systematic Investment Plans) in green mutual funds

- Add more as you gain confidence

My first investment was just 8,000 in a green energy fund. It wasn't much, but it helped me learn the ropes.

Step 3: Diversify Within Green Energy

Don't put all your money in one type of green energy:

- Solar has different growth drivers than wind

- Energy storage faces different challenges than generation

- Green transportation is a different ballgame altogether

I split my green investments between solar, wind, and energy efficiency companies.

Real Success Stories: Green Energy Investments That Paid Off

Let me share some success stories I've witnessed:

Case Study 1: Solar Boom

My colleague invested 1 lakh in a leading solar company in 2019. By 2022, his investment had grown to 2.7 lakhs. The company had secured several large government contracts for solar parks.

Case Study 2: The ESG Fund Growth

Another friend started a monthly SIP of 5,000 in an ESG-focused mutual fund in 2020. After two years, her investment had grown by 32%, outperforming many traditional funds.

Case Study 3: The Green Bond Safety

During market volatility in 2022, my green bonds maintained their value while some of my other investments dropped. They provided stability in uncertain times.

Common Questions About Green Investments

Here are some questions I often get asked:

Are green investments only for the wealthy?

Absolutely not! I started with just a few thousand rupees. Many mutual funds allow SIPs starting at 500 per month.

ow long should I stay invested?

Green energy is a long-term play. I recommend at least 5-7 years to see good returns. My best performing investments are ones I've held for 3+ years.

What if I don't understand technical aspects of renewable energy?

You don't need to be an engineer! Focus on business fundamentals, management quality, and growth potential. I knew nothing about solar panel efficiency when I started, but I understood good business practices.

Final Thoughts on Green Energy Investments

Investing in Indian greentech isn't just good for your wallet—it's good for our world too. Every rupee you invest helps build a cleaner future.

I remember showing my nephew my green investment portfolio. His eyes lit up when I explained that these companies were building solar parks and wind farms. "So your money is helping save the planet?" he asked. "That's exactly right," I told him.

Start small, learn continuously, and take pride in knowing your investments are making a difference. The Indian green energy revolution is just beginning, and there's plenty of room for growth.