Pale Blue Dot, a newly outed European venture capital firm focused on climate tech, announced this week the first closing of its debut fund at €53 million.

Targeting pre-seed and seed stage startups, the firm says it will consider software and technology investments with a strong positive climate impact. Current areas of focus include food/agriculture, industry, fashion/apparel, energy and transportation, with plans to back up to 40 companies out of fund one.

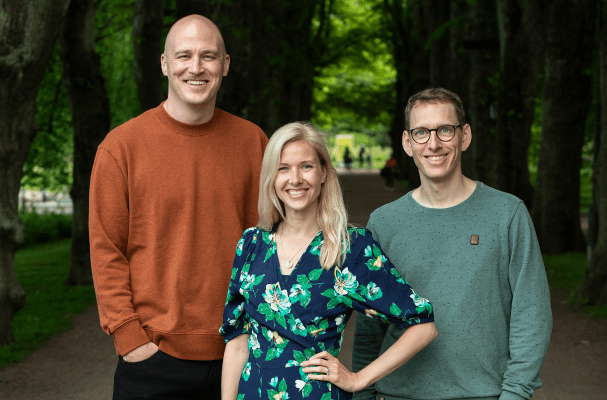

Founding partners Hampus Jakobsson, Heidi Lindvall and Joel Larsson are stalwarts of the Nordic tech ecosystem and beyond: Jakobsson co-founded TAT (The Astonishing Tribe), which was sold to Blackberry in 2012, and is a prominent angel investor in Europe, most recently a venture partner at BlueYard Capital . Lindvall is the former head of accelerator and investment team at Fast Track Malmö, with a background in human rights and media. Larsson was previously managing director at Fast Track Malmö, with a technical background and prior fund management experience.

I put questions to all three, delving deeper into Pale Blue Dot’s remit and the firm’s investment thesis. We also discussed the macro trends that warrant a fund specializing in climate tech and why Europe is poised to become a leader in the space.

Pale Blue Dot is a new VC fund specializing in climate tech, but in a sense — and to varying degrees — isn’t every venture capital fund a climate tech fund these days?

Heidi Lindvall: We think all funds should be “planet-positive” and working for a better world, but it will take time until it is a focus. Still, most funds look at a potential positive impact late in their assessment and will not decline the deal if the startups wouldn’t be significantly pulling the world in a good direction.

Hampus Jakobsson: Focus has both upsides and downsides.

The negative part with being niche is that we won’t do investments in amazing people or startups that we don’t think are “climate-contributing enough” or that the founders aren’t doing it in a genuine way (as the risk of them to paying attention to the impact might lead them to become a noncontributing company).