Have you ever watched Shark Tank India and thought, "I wish I could invest in cool startups too"? Well, guess what? You can! Having been putting money into Indian startups for more than five years, I wish to tell you what I have discovered. The startup environment in India is thriving, and there are now several avenues for ordinary people like us to participate in the enthusiasm.

How To Invest In Indian Startups Online: Getting Started

When I first got interested in startup investing, I had no idea where to begin. The good news is that today, investing in Indian startups is easier than ever before. Online tools and government backing mean you don't have to be a rich or have unique contacts to begin.

With more than 100,000 firms and still growing, India is currently the third-largest startup ecosystem in the world. These nascent businesses may be taking their early investors, creating employment, and addressing issues.

Why Invest in Indian Startups?

Before jumping in, let's talk about why you might want to put your money in startups:

- High growth potential - Some startups grow much faster than established companies

- Be part of innovation - Help bring new ideas to life

- Portfolio diversification - Add something different to your investments

- Support entrepreneurs - Help founders build their dreams

- Potential for big returns - If a startup succeeds, your returns could be significant

I still remember my first startup investment in a small fintech company. I put in 50,000, and while that company didn't become the next Paytm, it did give me a 2x return in three years. More importantly, it taught me valuable lessons about how startup investing works.

Read also: List Of Government-supported Indian Startups

Best Platform to Invest in Startups in India

Finding the right platform is crucial for your startup investing journey. Here are some of the best platforms to invest in startups in India that I've personally used:

1. Equity Crowdfunding Platforms

These websites let you invest smaller amounts in startups:

- LetsVenture - One of my favorites, with a minimum investment of 5 lakhs

- Tyke - Great for investing in pre-IPO companies with amounts as low as 5,000

- GRIP - Focuses on lease financing with returns of 18-21%

- Angel List India - Connects investors with startups, minimum usually 2.5 lakhs

I started my journey on LetsVenture and found their due diligence process very reassuring. They check the startup's background, legal documents, and business model before listing them.

2. Angel Networks

Angel networks bring investors together to fund startups:

- Indian Angel Network (IAN) - India's first angel network

- Mumbai Angels - One of the largest angel networks

- Venture Catalysts - Rapidly growing network with 5000+ angels

When I joined an angel network, the best part was learning from experienced investors. At my first Mumbai Angels meeting, I met a successful entrepreneur who shared invaluable advice about evaluating founding teams.

3. SEBI-Registered AIFs (Alternative Investment Funds)

For those with more capital to invest:

- Blume Ventures

- Fireside Ventures

- 3one4 Capital

These require higher investments (usually 25 lakhs or more) but give you professional fund management.

Platform to Invest in Startups India: What to Consider

When choosing a platform to invest in startups in India, keep these factors in mind:

1. Minimum Investment Amount

Different platforms have different minimums:

- Small budget (under 1 lakh): Tyke, Small Ticket

- Medium budget (1-10 lakhs): LetsVenture, GRIP

- Large budget (10+ lakhs): Angel networks, AIFs

I started with small investments on Tyke to get comfortable with the process before moving to larger commitments.

2. Deal Quality

Look for platforms that thoroughly vet startups. Good platforms will share:

- Detailed business plans

- Financial projections

- Team background information

- Market analysis

On one platform (which I won't name), I almost invested in a startup with serious legal issues that weren't disclosed. Since then, I only use platforms with strong due diligence processes.

3. Fees and Charges

Watch out for these common fees:

- Carry fee - A percentage of profits (typically 20%)

- Management fee - Annual fee (1-2% of invested amount)

- Platform fee - One-time or recurring charges

Always calculate how fees affect your potential returns before investing.

How To Invest In Indian Startups Online: Step-by-Step Process

Ready to start? Here's my simple process for investing in startups online:

1. Register on a Platform

Pick a platform from the ones mentioned above and complete these steps:

- Create an account

- Complete KYC verification

- Link your bank account

Most platforms will verify your identity within 1-2 business days.

2. Browse Available Deals

Once verified, you can explore startup investment opportunities. Look for:

- Industry sectors you understand

- Fouder background and experience

- Traction (users, revenue, growth)

- Investment terms (valuation, equity offered)

I spend at least 3-4 hours researching each potential investment before deciding.

3. Invest in Selected Startups

When you find a startup you like:

- Review all documents carefully

- Submit your investment commitment

- Transfer funds as directed

- Sign necessary agreements

My first investment took nearly a week to complete all paperwork. Now I can usually finish the process in 1-2 days.

4. Track Your Investments

After investing:

- Monitor quarterly or annual updates

- Attend investor meetings when possible

- Support the startups you invest in

I created a simple spreadsheet to track all my startup investments, including important dates and key metrics.

Funding for Startups in India by Government

The Indian government strongly supports the startup ecosystem. As an investor, it's important to know about funding for startups in India by government programs because they can help your investments succeed.

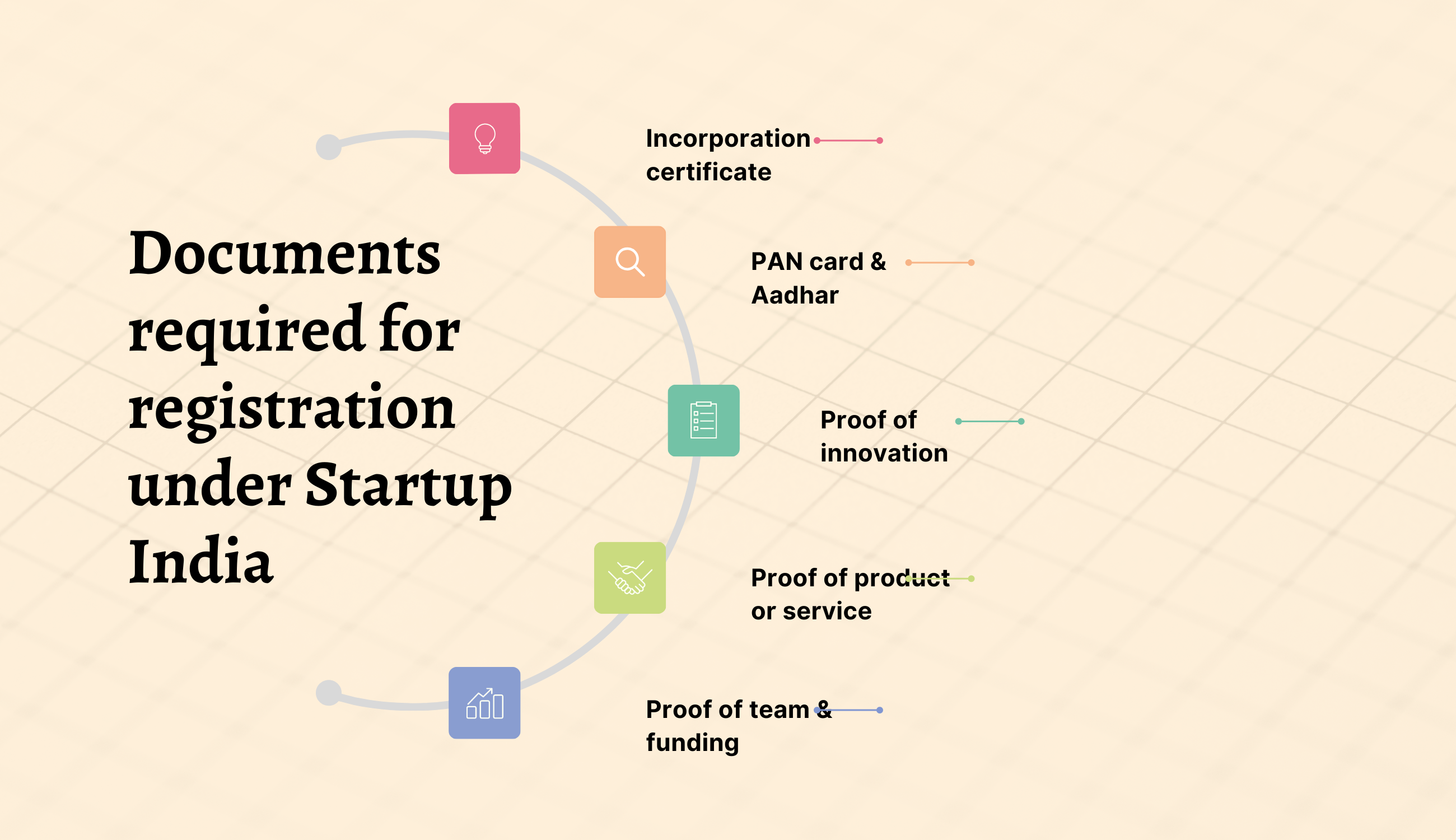

1. Startup India Initiative

Launched in 2016, this program offers:

- Tax benefits for startups

- Easier compliance procedures

- Funding support

- Incubation programs

I invested in a healthtech startup that received Startup India recognition, which helped them get a government grant of 25 lakhs without giving up any equity.

Read also: Fastest-growing Indian Tech Startups

2. SIDBI Fund of Funds

SIDBI has a 10,000 crore fund that invests in venture capital funds, which then invest in startups. This creates a larger pool of capital for the ecosystem.

3. Atal Innovation Mission

This initiative supports:

- Innovation hubs

- Startup accelerators

- Mentorship programs

One of my portfolio companies participated in an AIM accelerator program and gained valuable connections and business development support.

4. State Government Initiatives

Many states have their own startup policies:

- Karnataka - Elevate program

- Kerala - Kerala Startup Mission

- Maharashtra - Maharashtra State Innovation Society

These programs often provide funding, workspace, and mentorship.

Common Mistakes to Avoid When Investing in Indian Startups

Learn from my mistakes so you don't repeat them:

1. Putting All Eggs in One Basket

My biggest mistake was investing too much in just one startup. When it failed, I lost a significant amount. Now I follow this rule:

- Never invest more than 5-10% of your startup investment budget in one company

- Aim for a portfolio of 10-20 startups over time

2. Ignoring the Team

The founding team is crucial. Once, I invested in a startup with an amazing product but inexperienced founders. They couldn't handle the challenges of scaling, and the company eventually shut down.

Always evaluate:

- Founder experience

- Team completeness (technical, business, operations)

- Previous startup experience

- How they handle tough questions

3. Not Understanding the Business Model

If you don't understand how a startup makes money, don't invest! I once invested in a blockchain startup without fully understanding their revenue model. Big mistake.

4. Expecting Quick Returns

Startup investments typically take 5-8 years to provide returns. Don't invest money you might need soon.

Risk Management in Startup Investing

Startup investing is risky, but you can manage those risks:

1. Diversify Your Investments

I follow these guidelines:

- Sector diversity - Invest across different industries

- Stage diversity - Mix early and growth-stage startups

- Business model diversity - Combine B2B and B2C companies

This approach has helped balance my overall portfolio performance.

2. Only Invest What You Can Afford to Lose

I set aside a specific portion of my investment funds for startups—typically 10-15% of my total investment portfolio. This is money I can afford to lose if things don't work out.

3. Do Thorough Due Diligence

Before investing, I always check:

- Market size - Is it big enough?

- Competition - Who else is solving this problem?

- Traction - Do they have customers/users?

- Unit economics - Can the business be profitable?

- Legal issues - Any pending disputes or regulatory concerns?

Taking the time for proper research has saved me from several bad investments.

Success Stories: Indians Who Made It Big Through Startup Investing

These stories always inspire me:

1. Early Investors in Flipkart

Those who invested in Flipkart's early rounds saw returns of over 100x when Walmart acquired the company for $16 billion.

2. Zomato and Nykaa Investors

Angel investors in these companies sa their investments multiply many times over when these startups went public.

3. Regular People Winning Too

It's not just the ultra-wealthy who win. I know a school teacher who invested 3 lakhs in a fintech startup through an angel network and received 24 lakhs when it was acquired three years later.

Tax Implications of Startup Investments in India

Understanding taxes is essential:

1. Angel Tax

The government has exempted registered startups from angel tax, which is great news for investors.

2. Capital Gains Tax

When you exit your investment:

- Short-term gains (held less than 24 months): Taxed at your income tax slab rate

- Long-term gains (held more than 24 months): 20% with indexation benefits

I always consult my tax advisor before exiting any startup investment to optimize the tax implications.

3. Tax Benefits Under Section 80IAC

Startups recognized by DPIIT can get income tax exemption for three consecutive years out of their first ten years.

Read also: Best Indian Agritech Startups For Farmers

How To Invest In Indian Startups Online: Future Trends

Here's what I'm excited about in the Indian startup investment space:

1. Fractional Ownership Platforms

New platforms are enabling investments as low as 5,000 in startups, making it accessible to more people.

2. Secondary Markets for Startup Shares

Emerging platforms allow investors to sell their startup shares before an exit event, improving liquidity.

3. Sector-Specific Funds

We're seeing more funds focused on specific sectors like:

- Climate tech

- Healthtech

- Edtech

- Agritech

I've started allocating a portion of my investments to climate tech startups, as I believe this sector has huge potential in India.

Final Thoughts: Is Startup Investing Right for You?

Investing in startups isn't for everyone. Consider these points:

- Are you comfortable with high risk?

- Can you wait 5-8 years for returns?

- Do you have the time to research startups?

- Are you investing money you can afford to lose?

If you answered yes to these questions, startup investing might be a good fit for you.

I started my journey with just 50,000 five years ago. Today, I have investments in 12 startups, and while some have failed, others are growing well. More than the financial returns, I value being part of innovation that's shaping India's future.

Remember, start small, learn continuously, and enjoy the journey of supporting entrepreneurs who are building tomorrow's success stories!

FAQs About Investing in Indian Startups

What is the minimum amount needed to invest in Indian startups?

With platforms like Tyke, you can start with as little as 5,000. Traditional angel investing typically requires 2-5 lakhs minimum.

How long before I can see returns on my startup investments?

Typically 5-8 years, but it can sometimes be longer. Patience is key in startup investing.

Is it legal for retail investors to invest directly in startups?

Yes, it's completely legal. Platforms like LetsVenture and Tyke make the process compliant with all regulations.

What documents do I need to start investing in startups?

Basic KYC documents including PAN card, Aadhaar, bank statements, and sometimes income proof.

Can NRIs invest in Indian startups?

Yes, NRIs can invest in Indian startups, though there may be additional documentation requirements. Remember, the best investments come from understanding the business, believing in the founders, and having patience. Start your startup investment journey today, and who knows—you might just fund the next big Indian unicorn!