In the event that your organization has accomplished no less than $10M in repeating income with unsurprising future development, low stir and closeness to income positive, then, at that point, you can add private value to your leave choices.

As of June 2017, worldwide Private Equity capital under administration remained at $2.83 trillion.¹ $1.7 trillion is in dry powder, fit to be conveyed in stage and extra buyouts. Moreover, the quantity of private value firms pursuing buyouts has developed fundamentally:

In Q1 2018, 23% of generally Private Equity buyouts were in the IT area — the most ever.² In 2017, 19% were in IT — 823 arrangements. In that year, $40B was raised by Private Equity assets for interests in IT.³ The majority of this action was in North America, however acquisitions happened in Asia and Europe also.

Why such a lot of interest in IT? As the accompanying realistic shows, IT speculations have are averaging more alluring returns, with less standard deviation, than elective venture areas.

source: google.com

On the off chance that you are the Chief of a tech organization headed towards leave, it's plainly time to give a Private Equity exit serious thought. There are more PE firms with more money to contribute. There's more cheap obligation accessible today. There's the consistent shift towards IT as the venture area of decision for monetary supporters. Bargain rivalry from the expanded number of private value supports zeroed in on IT and enterprises looking for key acquisitions is pushing valuations higher. For this multitude of reasons, the markdown spread that ordinarily exists among vital and Private Equity exits has evaporated, particularly for developing repeating income organizations.

Characteristics of the Ideal Private Equity Procurement Target

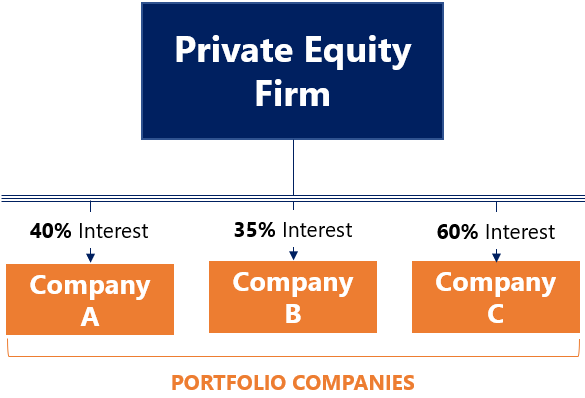

The Private Equity venture proposition relies upon the post-procurement procedure to drive speculation returns. Disadvantage risk should be low, and potential gain opportunity high. PE firms search for organizations that are at income positive, or near it. Repeating income plans of action are inclined toward. Income and logo stir should be low. Client procurement costs should be moderately low. Incomes underneath $10M aren't intriguing.

However, alongside the rundown of things PE firms care very much about, there are things they couldn't care less probably as different purchasers. In the event that you are not the market chief, that is alright the same length as your repetitive money profile is protected and development is unsurprising. Yet again assuming the space you are in is undesirable, or your innovation is maturing, that can be alright as well, insofar as repeating incomes are protected and there is as yet unsurprising development. Also, if you as Chief need to leave after the exchange is finished, that is alright as well — PE firms hope to change out administration eventually at any rate.

When it's reasonable drawback risk is low, a PE company's center goes to potential gain influence. Here are the main switches a PE firm will consider:

Valuable chances to lessen costs

Cost increment potential

Potential for add-on, wrap up scale acquisitions

Initiative overhaul amazing open doors

Channel organizations

Income motor upgrades

Each Private Equity securing relies upon a speculation brings postulation back. Whenever you have affirmed that your organization is a feasible PE focus with humble disadvantage risk, now is the right time to imagine the PE company's perspective and sort out the speculation switches. In the event that you remember a strong development proposition for your PE pitch, you will teach a responsive crowd — yet in the event that you have no or restricted showed development, a benefits or solidification story will be expected to create revenue and de-risk venture returns.

The Private Equity Investment Thesis

source: google.com

The case for private value depends on execution. LPs spend truckloads of cash on PE firms looking for outsized returns. The top quartile of US reserves has conveyed net IRR going from 20% to 30% throughout recent years.

Here is the conveyance of products at exit over the long haul, for the US and created Europe:

To accomplish these results, PE firms frequently use obligation influence to increment returns. The typical hold time is five years, and during this time the mission is to fabricate greatest worth.

Two Bites at the Apple

As President, you and your top group have one more significant motivation to consider a Private Equity leave: a second chomp at the apple. In a Private Equity exchange, you can hope to get cash for the vast majority of your value. Yet, most PE firms will anticipate that the President should turn over some of it. A study by the law office Goodwin Procter viewed that as 70.7% of PE firms "commonly expect" Chief to turn over a part of pre-exchange value. Overall, this rollover segment is 24.1% of the Chief's pre-exchange holdings.

Expecting you drive the organization's presentation post exchange and lead the organization towards a thrilling resulting exit, your subsequent chomp may be significantly greater than your first. Here is a made up illustration of how the math could help you out. In the main case, you offer to a key ("Key Arrangement to Dealer") and take a 100 percent cash payout, which yields you $50M. In the subsequent case, "PE Arrangement to Merchant", you get a lower beginning money payout — $40M of money, with $10M designated to a value rollover — yet expecting the subsequent exchange accomplishes 3X (impelled to a limited extent by the PE obligation influence) then another $30M returns to you — for $70M in complete returns.

That’s two bites of the apple:

It's even conceivable to have three nibbles, if your PE proprietor ways out to another PE financial backer. PE to PE is a rising pattern in the Private Equity world.

Assuming you really do consent to an exchange that incorporates a rollover necessity, ensure these offers are similar class of offers as held by the Private Equity firm — whether liked or normal. Your portions ought to rank pari passu in position close by the PE association's own portions in the organization (there are a few exemptions for this, however, when in doubt, they ought to be a similar class of value). Additionally, make a point to address what befalls those offers when and in the event that your work ends.

Management Compensation

source: google.com

PWC's 2016 pay review of private value portfolio organizations observed that cash pay for senior chiefs was predictable with public organization comparisons. The executives value pools arrived at the midpoint of 12%. Value interest was typically restricted to the initial a few degrees of the board. For innovation organizations, only 6.9% of representatives got investment opportunity awards. For PE firms, most (74%) invesment opportunity plans were organized to vest in view of a blend of time and benefit execution. Private Equity firms will quite often give out value in a more saving manner than their endeavor partners, and there is a great many ways to deal with worker value, so understanding a PE company's way to deal with value will assist you with evaluating fit.

What to Expect if Owned by PE?

source: google.com

Post securing, your board will be contained fundamentally of PE firm chiefs. These chiefs will be dynamic accomplices in immeasurably significant business choices. As President, you will communicate oftentimes with them. In the event that you esteem autonomy, you won't remain Chief for a really long time.

As a matter of fact, Alix Accomplices' 2018 Yearly Private Equity Overview viewed that as 58% of PE firms hope to fire the President in no less than two years of an obtaining. 78% hope to do so at some point in the speculation life cycle. A different report led by leader search firm Reynolds and Reynolds found that for top performing organizations, 38% of Presidents in the seat at the hour of the exchange were still in the seat at exit. For base performing organizations, simply 23% came to the completion line.

PE firms frequently begin accepting that the current President is a manager, however at that point close in any case after some time. In an examination of arrangements that accomplished capital impedance, Bain Counseling found that underlying feelings of the supervisory crew were frequently too positive.

Your PE proprietor is intensely aware of the need to act rapidly in the event that a President misses the mark concerning execution targets or demonstrates excessively free. So if you have any desire to stay with running the, you should zero in on conveying prompt outcomes. Functional execution, as shown by cost proficiency and solid income development, will be foremost. PE firms need to see Presidents who act with earnestness to drive the business forward.

While PE firms regularly look to limit subsidizing misfortunes in the center business, they are glad to put resources into add-on acquisitions where they check out. As a matter of fact, you might be tested to scour for accretive obtaining potential open doors forcefully.

One thing you won't have to invest energy on is raising money, except if you head towards Initial public offering. In the event that kept financing is required, the PE firm will deal with it.

The objective, obviously, is to construct worth to the place where you can accomplish a profoundly fruitful exit. There are three potential leave pathways: deal to an essential, deal to another PE firm, or Initial public offering.

Private Equity Firms

source: google.com

Thoma Bravo and Vista Accomplices have both raised 10-figure assets for putting resources into innovation. What's more, that is only a glimpse of something larger.

Reserve size is inexactly related with bargain size. The exceptionally huge assets seek after serious deals — for example, Silver Lake Capital took Dell private. Extremely huge buyouts of mature organizations are the space of exceptionally enormous assets, while the more modest assets are doing more modest arrangements. It is likewise significant that a considerable lot of these financial backers have numerous assets (e.g., Accel-KKR has a buyout reserve and a development value store; Vista Value Accomplices has three unique buyout reserves focusing on little, medium and huge exchanges). Some do both funding and PE buyouts (e.g., JMI, Understanding Endeavor Accomplices).

Summary

No matter what the firm, you can anticipate that PE financial backers should be sharp arrangement producers. So come ready, and ensure you consider cautiously about the potential gain (e.g., a few nibbles at the apple) and disadvantage (e.g., more serious gamble of being supplanted) of the PE leave way. As is commonly said, "be cautious what you request — you very well could get it."