An investment refers to capital provided to a company by a party whose goal is to benefit from the future success of the company. Investments can take the form of equity shares, which provide capital in exchange for the company's equity, or debt investments in the form of a loan repaid with interest over time.

An exit occurs when a company's shareholder sells his or her shares at a profit or loss. The founders, owners, investors and all other parties holding shares in the company will each exit independently. The most profitable exits occur when a company is acquired by another or goes public.

How does investing in startups work?

Startups depend on investments to start the business. An investor provides the financing that allows you to lay the foundations of the business and hopefully grow it in the future. This money can provide a startup with the resources needed to bring a product or service concept to fruition. Investing involves risk on both sides, but offers the potential for exponential growth and significant profits for startups and their investors.

Investing in a startup can be a task simple. or something very complicated. Several details come into play when deciding whether a company is ready to accept an investment. There are different methods for investing in startups, depending on how the investor wants to get a return on investment and what the startup needs for effective growth.

Investors can negotiate with the owners the timing, type of investment and size of the investment. The process usually begins with an investment proposal. If the owners agree, contracts are negotiated and signed and capital is distributed to the owners.

Capital vs. Debt Investment

An investment in a startup can be made by acquiring shares or providing financing that the company can then repay with interest.

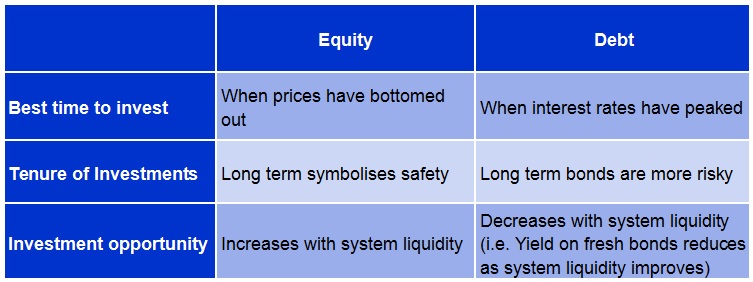

Equity investments are made to acquire a share or percentage of a startup. Investors provide startups with the capital and resources needed to grow, while startups trade a percentage of their value that generates profits when it comes time to exit. This investment does not have to be returned to the investor.

Alternatively, debt investments are considered loans and are purchased against the company's existing assets. Startups agree to repay the entire loan to the investor at a fixed interest rate over time, including accrued interest. While debt investments generally carry less risk and can be realized quickly, stocks have the potential to generate higher returns over the long term.

Types of Investors

Equity investors

Personal investors

Private investors are individuals or groups of people with personal ties to the company's founders or executives, such as family and friends. Typically, these groups can provide only limited resources; However, they often offer the cheapest interest rates of any lender. Crowdfunding methods can also be classified in this category.

Accelerators and incubators

Growing and growth-stage companies At Seed you can sign up to participate in an acceleration or incubator program that provides a company with financing of a variable amount and allows it to subsequently enter a cooperative space with other founders in exchange for a percentage of the business. Accelerators and incubators offer networking opportunities and lay the foundation for business growth, while opening up new investment opportunities.

Angel Investors

Many young companies cannot receive venture capital due to their size and age. This is where angel investors come in. This type of investor typically works with seed funding and additional rounds, generally offers cheaper interest rates than venture capital firms, and prefers to invest in companies with high volatility risks.

Venture Capitalists

Venture Capitalists, individually or as part of a venture capital firm, often provide the largest amounts of funding to startups during Series A, B, or Series C funding. I Venture capitalists tend to come under the most scrutiny when it comes to investing, taking into account everything from the company's age to its location, but they can make the biggest difference when it comes to gaining market share.

Corporate Investors

When companies have significant cash, they can use it by investing in smaller companies. As with retail investors, each company may have different policies regarding capital ratios and funding amounts. Corporate investors can sometimes put companies in the awkward position of prioritizing profits over revenues, but they can be a good first step toward taking control.

Public Listing

Fast-growing companies have the option of taking their organization public to sell shares or small percentages of company in variable quantities to individual buyers. . These buyers therefore run the risk that the valuation of these shares will fluctuate over time and can sell their shares to third parties at virtually any time.

Debt Investors

Banks

Banks are among the most traditional lenders and can offer direct access to finance in the form of "interest" . Loans are available and must be repaid within a certain period of time. Banks are very discreet when granting loans and require detailed documentation and financial information, but they are often helpful partners in getting a small business up and running.

Discount Providers

Invoice discounts allow growing businesses to make ends meet quickly by providing advances on a percentage of the company's invoices. They grant these advances for remuneration and pay interest on the funds made available. Some invoice discounters even manage the company's receivables ledger so the company can prioritize growth.

Other types of invoice discounters, investors < /div>< div>Many founders can obtain funding through government grant programs designed to help innovative companies grow. Grant funds generally do not require a return or capital, but may be limited to certain groups and categories.

How do investors make money?

The company does not reimburse equity investors. Equity investors, on the other hand, own a percentage of the company and have the option to subsequently sell their shares on the stock exchange, to other investors or to an acquiring company as part of an acquisition. These investors benefit from the increase in a company's valuation over time and accept the loss of their investment if the company fails.

Debt investors expect that a company pays all debts. loan amount, including all accrued interest, over a specified period of time. If a business fails to do so, the debt collection process begins and business owners may have to pay more. If a company does not have the assets necessary to repay a loan upon liquidation, bankruptcy proceedings may be initiated and the creditor may seize some of the company's remaining assets.

What is a reasonable percentage for an investor?

Investment percentages vary widely depending on the terms of each agreement, but these are some of the most common fees. What you need to know depending on the type of investment:

Most accelerators have a non-negotiable equity ratio of between 4 and 7%.

- The amount of capital available to angel investors depends entirely on the amount of capital they are willing to put into their investment. The more capital they provide, the more they receive. Ultimately, a company should be willing to divide 20-30% of its capital among its angel investors.

- Venture capitalists want to have more influence over a company's decisions when making their investments, but they can usually provide most of it. of financing. For all investors, companies should therefore expect between 30 and 40% of capital to be allocated to this group.

- Banks can often be the most accurate lenders and take many factors into account when setting capital interest rates, including loan amount, company. solvency, the age of the company and its financial situation. Traditional bank loans for small businesses typically range between 3 and 7 percent, but can sometimes be much higher.

- After you've completed all your fundraising and acquired the loans you need to grow, founders can expect to earn 20% to 20%. 30. percentage of this amount will be retained by the companies in your group.

How to Find Investors?

Attract angel investors

As with many aspects of business, the best way is to follow the following method: Attracting angel investors requires networking. Through contacts made over the years, someone recommending an angel investor, or online methods such as networking apps or websites, angel investors can be found in many places. Having a presence in an accelerator or incubator can also be a natural way to attract angel investors where they are already looking.

Search for small business loans

Small business owners may be in a better position to apply for private loans from independent entities or obtain bank loans. A combination of the two will allow these owners to pursue their core vision with less outside interference, while maintaining a larger share of their company's profits. Personal loans are typically made between friends, family and business partners and have low interest rates and favorable terms.

What is an exit strategy?

An exit strategy is the path taken by an equity investor to invest in a startup . Convert money. (For debt investors, exit takes place as soon as the loan given by them is fully repaid along with all accrued interest.)

Exit takes place at startup Larger companies are acquired by corporations or when they do an IPO and go public. In the case of an acquisition, investors receive compensation for their shares or a comparable number of shares of the acquiring company.

Regardless of how an exit is initiated, founders and investors must have a clear understanding of their exit strategy to achieve their goal.

Develop an exit strategy

An exit strategy ensures that the value of the company remains intact and is protected during the transition. It also ensures that management and employees are successful during the transition and that founders receive a source of income if they remain with the company. All of this means that it is important to review your exit strategies frequently and with input from all stakeholders, in line with your objectives, before moving forward.

Every company is unique, so no two exit strategies are the same, and the details vary depending on the type of exit and the needs and wants of the acquiring company. of the company you are leaving. , investor objectives, number of stakeholders and more. Shareholders can exit at different times, but it is critical that a company focuses on a common goal, such as an IPO or an acquisition, but not both.

Examples of exit strategies

A Merger occurs when two companies merge to form a larger company and the core members, including the owners, remain involved in the new company. The owners of each old company will be co-owners of the new company. Although the owners of the merged companies become owners of the newly created company, this is still considered an exit strategy because the two separate companies no longer exist.

Acquisition - Strategy exit

Small businesses are often acquired by larger companies rather than merging. The acquiring company becomes the owner of all assets and outstanding debts of the company, including the realization of existing investments, and acquires the entire share capital of the company from the owner. If acquired by a listed company, owners can receive shares in the acquiring company and a lump sum or even employment in the acquiring company. Any combination of these factors can be resolved through an acquisition agreement, and the company can choose to keep the newly acquired company alive under its umbrella or to dissolve it and integrate its operations into existing products.

Private Sales Exit Strategy

Private sales are agreements between two parties in which entrepreneurs agree to a transfer of property by another person. This most often occurs when a small business owner decides to retire or leave the business for any reason and wants to keep it running. Buyers can randomly offer a private sale and have no connection to the owner. But often those interested in acquiring a private business are current employees, friends or family who are more likely to be approached than the owner. In these cases, many owners are willing to finance the sale, allowing the buyer to raise a portion of capital and repaying the balance of the transaction over time.

Exit from IPO Strategy

The owners of the most successful companies have the option of taking their companies public via an IPO or an IPO and trading their shares on the stock exchange. This is a rare phenomenon (currently only around 7,000 companies are listed on the stock exchange) and requires considerable work.

An IPO sets the price at which the general public can purchase shares of a company on the first day of its incorporation. Equity investors keep all of their shares, and entrepreneurs keep a certain number of shares while the rest are made available to the public. The feasibility and pricing of an IPO will be decided based on input from all interested parties, investment banks, the Securities and Exchange Commission (SEC), and the company's financial records.

Liquidation Exit Strategy

Liquidation is the simplest exit strategy and occurs when an owner decides to close the business. All company assets are sold, converted into cash and used to pay off outstanding debts. If any capital remains after liquidation, it will be distributed to shareholders according to their ownership percentage. If the money generated is not enough to pay off the debt in full, a settlement can be reached or the owner can declare the company bankrupt. In this case, an appointed administrator will distribute the remaining company assets among the creditors.

By SSP

![YouTube Shorts Monetization Guide [How Much Can You Make?]](/featured/2023/10/youtube-monetization-3-310x286.png)