For your business, you are probably charged VAT on most of the goods and services you buy.

That ways charging your customers VAT, keeping VAT records and paying the VAT you’ve placid to HMRC.

Read this vendible to learn increasingly well-nigh VAT.

Here’s what we cover:

- What is VAT?

- What is the UK VAT Rate 2022/23?

- Who pays VAT?

- What is the UK VAT registration threshold?

- How to pay your VAT bill

- How to tuition VAT

- Understanding VAT terms and phrases

- Final thoughts: Getting to grips with VAT

What is VAT?

Value Added Tax, or VAT, is a tax unromantic to goods and services.

Sometimes VAT is tabbed a consumption tax, considering it’s unromantic to end consumer purchases.

It’s unromantic by the individual or merchantry selling the goods or services as a percentage on top of the sale price. In other words, if something is sold for £1, then the price charged to the consumer will be £1.20 (if the 20% standard VAT rate is applied).

VAT is important considering it’s one of the biggest single forms of government revenue, representing 6% of national income. Worldwide, it finance for 20% of tax revenue for governments.

It’s important for businesses considering registering for VAT often lets them reduce the value of VAT they pay on their own purchases.

In the UK, VAT is unromantic by businesses or individuals on behalf of the government. The merchantry or individual must report the value of VAT they’ve both placid and moreover paid via periodic VAT returns.

Typically, these are submitted every three months (quarterly), but some businesses submit them monthly or annually.

Following submission of the VAT Return, the merchantry or individual must pay the wastefulness of the VAT to the government. That is to say, they pay the VAT they’ve placid minus the VAT they’ve been charged by others.

Push-Up Stands

Strauss Multifunctional Portable Push Up Board & Bars

Heavy duty, light weight, premium plastic "plug & press" push up board with multiple angles, double locker non-slip hand grips, portable, simple assembly perfect for home, travelling, outdoor, office etc

Only businesses or individuals that have registered for the VAT system can tuition VAT. Registration is mandatory once the turnover of the merchantry reaches £85,000.

But it’s moreover possible to voluntarily register for VAT if your turnover is lower than this.

What is the UK VAT Rate 2022/23?

There are three rates of VAT that are unromantic depending on what’s stuff sold.

Sometimes, the situation in which the goods or services are stuff sold can stupefy which rate is applied, too.

For example, some powerlessness products can be zero-rated for VAT – but only if they’re sold to people who are disabled.

This is what the current VAT rates are:

It’s important to understand that zero rated isn’t flipside way of saying something is exempt from VAT, or VAT-free.

You still have to make a note of zero-rated sales or purchases in your VAT accounting, and issue correct VAT invoices if they’re required.

Let’s take a squint at how much is VAT in the UK.

John Smith runs an eBay shop selling computer parts he imports from China. One of them financing him £90, and he adds a 30% profit margin.

That brings the retail price up to £117.

When he sells this, he adds 20% VAT, bringing the price up to £140.40.

He works this out by simply multiplying his sale price by 1.2 (and if he wanted to work out a price for something he’s ownership minus its VAT component, he could simply divide the price by 1.2 instead – thesping the 20% standard rate applies).

If John sells to flipside VAT registered merchantry then he still charges VAT in the same way.

However, this is considered input VAT by the purchasing business, and they can use it to offset the VAT they’ve placid on their sales.

John must provide them with a correctly formatted VAT invoice, showing the rate and value of VAT applied, among other things.

How VAT has changed

VAT was introduced into the UK in 1973 but had been used in Germany and France from the 1950s onwards, where it was sometimes referred to as a goods and services tax (GST).

This is how countries such as Australia, New Zealand and Canada protract to refer to their own VAT-like tax.

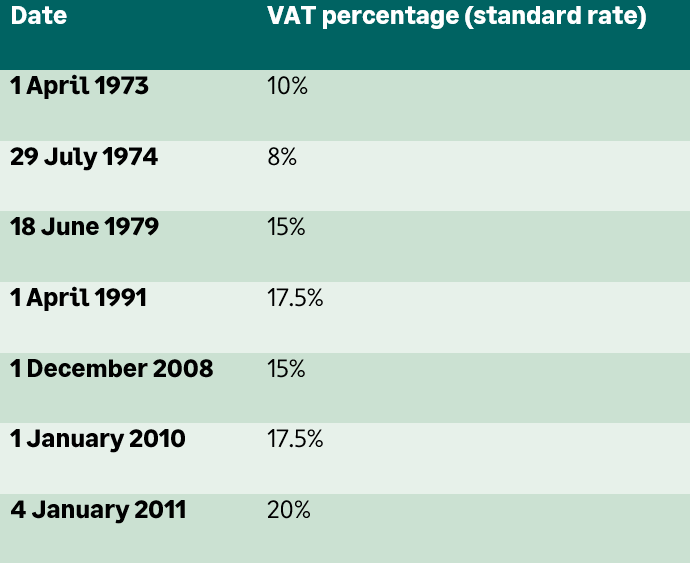

Upon introduction in the UK in 1973, the standard rate was 10%. Since then it’s risen and occasionally fallen.

Today’s rate of 20% is the highest that’s overly been unromantic and has been maintained for a decade, despite standing political pressure to reduce it.

At one point in UK tax history there was plane a higher rate of VAT, charged at 25% (although reduced to 12.5% a little later).

This unromantic to petrol and items considered luxuries such as fur coats, hi-fi equipment, televisions, and jewellery. However, this rate was superseded in 1979.

Here’s the historic standard VAT rates, starting with the introduction of VAT in 1973:

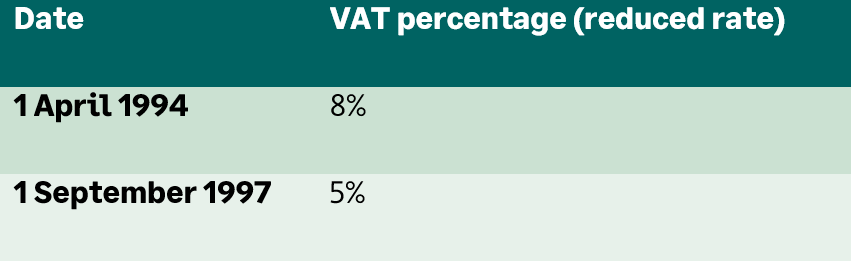

And here’s the historic VAT rates for the reduced rate, which is much increasingly straightforward:

Who pays VAT?

VAT is paid by consumers on purchases they make from VAT-registered businesses. As such, it’s an end-user tax unromantic at the point of consumption.

When it comes to handing VAT to the government, that’s the responsibility of VAT-registered individuals and businesses.

They pay the VAT to the government without filing their monthly, quarterly or yearly VAT Returns.

Until the deadline for payment, which is usually one month and seven days without the end of the VAT period, the merchantry gets to hold on to the VAT money.

And there’s nothing wrong with putting it into a upper interest account, or plane using it to help with mazuma spritz (e.g. powerfully giving a short term loan to yourself).

You just have to make sure the money will be misogynist when it’s needed to pay the VAT bill.

VAT is one of a small number of tax systems that turn businesses into unpaid tax collectors for the government.

However, the benefits of stuff worldly-wise to requirement when tax spent on purchases makes this worthwhile.

What is the UK VAT registration threshold?

Businesses with a VAT taxable turnover whilom a unrepealable value must, by law, register for VAT.

The exception to this is if the merchantry only sells goods or services that are exempt from VAT.

The current VAT threshold is £85,000. If your turnover for which VAT applies goes over this, you are required to register for VAT.

The government says there are fundamentally two ways to measure if you’ve passed the threshold, or will do so soon.

Either can be true to require you to register for VAT:

- You visualize going over £85,000 in VAT taxable turnover in the next 30 days.

- Your VAT taxable turnover was increasingly than £85,000 over the past 12 months (a rolling 12 month period from today’s date, rather than a timetable year).

It can be difficult working out when you should register for VAT. Speaking to your purser can help considering they can help forecast your income for the coming period.

But what’s known as the VAT trap arises when a merchantry finds itself crossing the VAT threshold, yet without having charged VAT to customers and without the required VAT accounting.

How to pay your VAT bill

When it comes to handing over the VAT payment to HMRC, you have several options.

Most businesses use uncontrived debit.

This simplifies things significantly and ways you needn’t think well-nigh it, other than ensuring the funds are misogynist in the correct worth at the right time.

However, if you want to alimony increasingly tenancy over payments then other options are available, as follows.

But you must remember that some payment methods take up to three working days to be processed (including uncontrived debits), and there might be surcharges too.

Making Tax Digital for VAT simplifies the whole procedure virtually collecting and reporting VAT by requiring the use of software. This makes it a sure-fire to know when payments are due. You can learn increasingly well-nigh MTD by visiting our MTD hub.

Same day payments

- Online (Faster Payments, CHAPS or via wall transfer using online banking)

- Telephone (Faster Payments)

Up to three working days

- Online (BACS or via debit or corporate credit card)

- Direct debit

- Standing order (only for Yearly Written Scheme, or payments on account)

- In person at your wall or towers society

You may need to speak to your wall or towers society superiority of time to see if they’re signed up to the Faster Payments system.

How to tuition VAT

Charging VAT is pretty simple. You just add the relevant VAT percentage to your sale price, which the consumer then pays.

For example, you tuition the consumer £12 for a widget that financing £10 and has VAT unromantic at the standard rate of 20% (i.e. £10 20% = £1.20).

There’s no legal requirement to list prices including VAT but not doing so might incur the wrath of the Advertising Standards Authority.

Because not including VAT in listed prices is so common, they include the requirement in their Committee of Advertising Practice guidelines.

However, if you mostly sell to other businesses, you might list prices without VAT provided this is unmistakably indicated.

If your consumer is moreover VAT registered then you must provide a VAT invoice. This differs from standard or vital invoices because, by law, it needs to contain spare information.

For those using the vital VAT system, it should include the following:

- A unique invoice number.

- The time of the supply (that is, the goods or service you sell).

- The stage of issue of the document (required only if this is variegated to the time of supply).

- Your name, write and VAT registration number.

- The name and write of the person to whom the goods or services are stuff supplied.

- A unravelment sufficient to identify the goods or services supplied. Each unravelment should list the quantity of the goods or the extent of the services, and the rate of VAT and the value payable, excluding VAT.

- The total value payable, excluding VAT.

- The rate of any mazuma unbelieve offered.

- The total value of VAT chargeable, expressed in sterling.

- The unit price.

- The reason for any zero rate or exemption.

Understanding VAT terms and phrases

VAT has its own terminology, which can be very confusing. So here’s some simple definitions to help you get to grips with charging, reporting, invoicing and paying VAT.

Input VAT

The VAT you pay on purchases that you can subsequently claim.

Output VAT

The VAT you tuition on sales.

VAT Return

The periodic tax returns you must submit to HMRC as part of your VAT obligations. Nowadays this must be washed-up digitally, via software, as part of the Making Tax Digital for VAT rules. The VAT Return contains nine boxes that you fill in, as applicable.

VAT period

The period for which you summate and then report VAT via a VAT Return. Typically this is quarterly (every three months), but it can be monthly or annually depending on the needs of your business.

Supplies

The goods and services you sell. For example, if you sell a widget to a consumer, then you have made a supply.

Inputs

The goods or services you buy to which VAT is unromantic by the seller.

Flat rate scheme

An volitional to gingerly VAT where you instead wield a unappetizing rate percentage to your total turnover. This makes things simplifier but could midpoint you end up handing over increasingly VAT than you would otherwise.

Tax point

The stage when the supply of goods or services is deemed to have taken place for the purposes of VAT accounting.

VAT invoice

An invoice that lists items such as the rate and value of VAT, plus your VAT registration number. Supplying one each time isn’t a legal requirement but customers can request one, and any individual or merchantry that’s VAT-registered should do so.

Threshold

The turnover value for you or your merchantry vastitude which you’re legally required to register for VAT. Currently this is £85,000 and it applies only to the VATable goods or services you sell (this should be unromantic to total VATable turnover and not just profits). The threshold typically increases yearly.

Retail schemes

Several alternatives to gingerly VAT that simplifies VAT written for retailers. Included is the point of sale scheme, which lets you increasingly hands summate VAT from your daily gross takings (DGT). It moreover includes two uncontrived circulation schemes, and two uncontrived numbering schemes.

VAT registration number

The individual number that applies to your merchantry and identifies it for VAT written purposes.

Distance selling

Before Brexit, sales to countries in the European Union (EU) were referred to as loftiness sales. Following Brexit, only sales from Northern Ireland to the EU are considered loftiness sales for UK businesses. Sales to EU countries from Great Britain and considered exports.

One Stop Shop

A scheme by which you can worth for VAT in a single return when selling to consumers within EU countries.

Final thoughts: Getting to grips with VAT

VAT can be troublemaking but getting to grips with it takes only a little effort, and once you’ve learned what you need to know you can get on with your merchantry just like thousands of others in the UK.

Don’t forget that seeking expert help is unchangingly a good idea.

Accountants and other tax experts work with VAT day in, day out. Speak to them if you’re struggling with any of the details, or how to implement VAT within your business.

Editor’s note: This vendible was first published in August 2017 and has been updated for relevance.

The post UK VAT rates and VAT FAQs appeared first on Sage Advice United Kingdom.